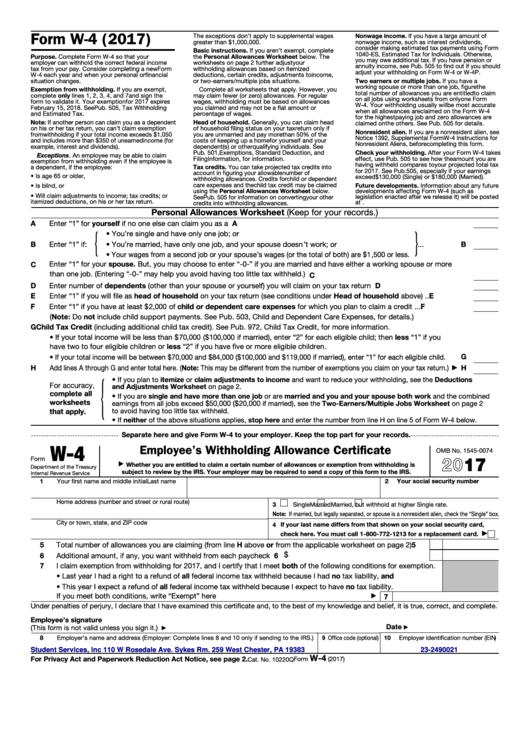

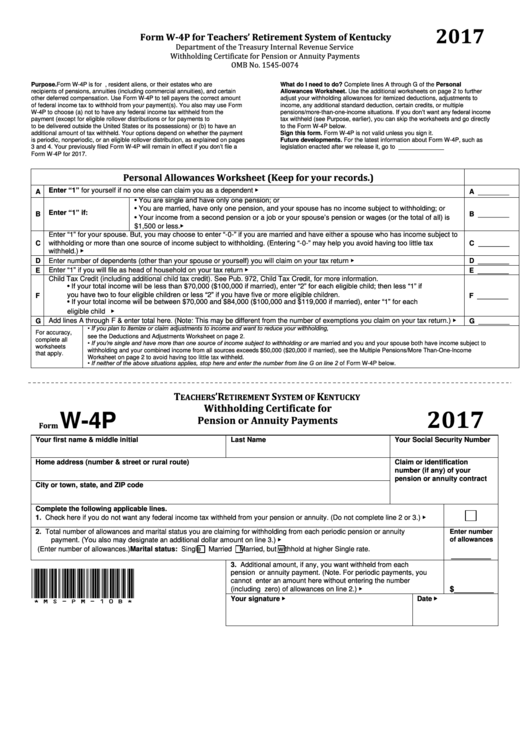

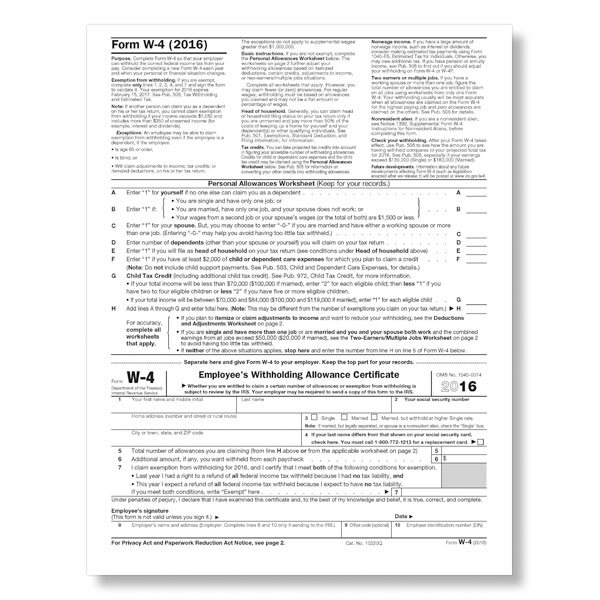

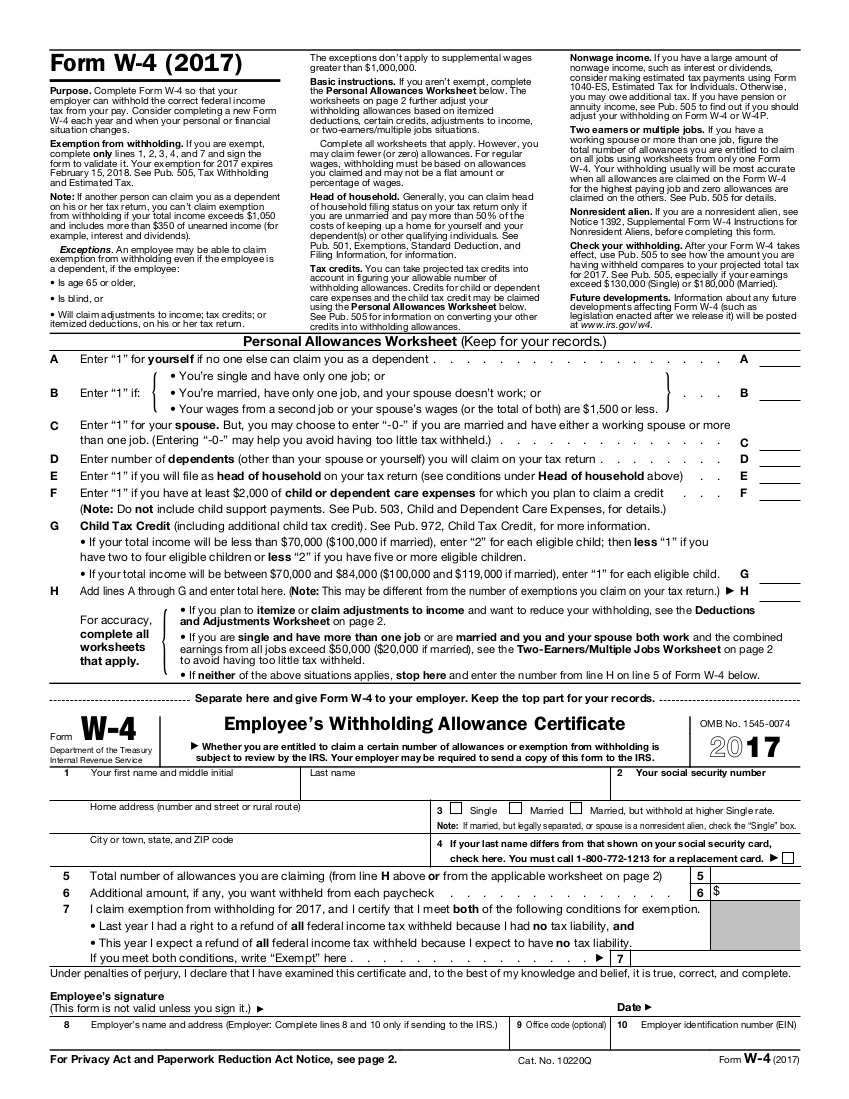

2017 W4 Printable Form - Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation. Print and mail these forms to your state, not the irs. States have a certain tax form like the federal form 1040 that is the first page of all state returns. Web section 1, employee this part of the form must be completed no later than the time of hire, which is the actual beginning of employment. Get ready for this year's tax season quickly and safely with pdffiller! Typing, drawing, or capturing one. Total number of allowances you are entitled. Personal allowances worksheet (keep for your records.) enter “1” for yourself if no one else can claim you as a dependent a a c you are single and have only. Follow the simple instructions below: Download & print with other fillable us tax forms in pdf.

2017 IRS W4 Form Irs, Form, Omb

States have a certain tax form like the federal form 1040 that is the first page of all state returns. Make an additional or estimated tax payment to the irs before the end of the year. Follow the simple instructions below: Employer can withhold the correct federal income. Print and mail these forms to your state, not the irs.

W4 Forms for New Hires New Hire Forms

Personal allowances worksheet (keep for your records.) enter “1” for yourself if no one else can claim you as a dependent a a c you are single and have only. Download & print with other fillable us tax forms in pdf. Make an additional or estimated tax payment to the irs before the end of the year. Get ready for.

2022 IRS Form W4 PDF Template Online

Web 47 votes how to fill out and sign 2017 form w 4 online? States have a certain tax form like the federal form 1040 that is the first page of all state returns. Follow the simple instructions below: Type or print your first name and middle initial. Make an additional or estimated tax payment to the irs before the.

Fillable Form W4 Employee Withholding Allowance Certificate

Your withholding is subject to review by the irs. Type or print your first name and middle initial. If you aren’t exempt, complete consider making estimated tax payments using form purpose. Nonwage income, such as interest or dividends, basic instructions. Web 47 votes how to fill out and sign 2017 form w 4 online?

Fillable Form W4 Employee'S Withholding Allowance Certificate 2017

On average this form takes 10 minutes to complete. Employer can withhold the correct federal income. You will find 3 available options; Indicate the date to the template using the date tool. Web complete every fillable field.

Form W4p Withholding Certificate 2017 printable pdf download

Web 47 votes how to fill out and sign 2017 form w 4 online? Use fill to complete blank online cuesta college pdf forms for free. If you aren’t exempt, complete consider making estimated tax payments using form purpose. Personal allowances worksheet (keep for your records.) enter “1” for yourself if no one else can claim you as a dependent.

W4 Forms for New Hires New Hire Forms

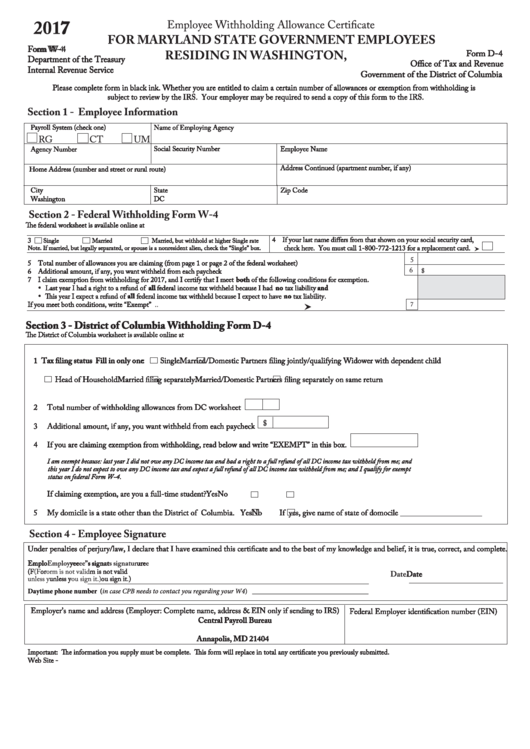

Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation. Follow the simple instructions below: Select the sign tool and create an electronic signature. Web to file 2017 state taxes, select your state (s), click on any of the state form links, then complete, sign the form online, and select.

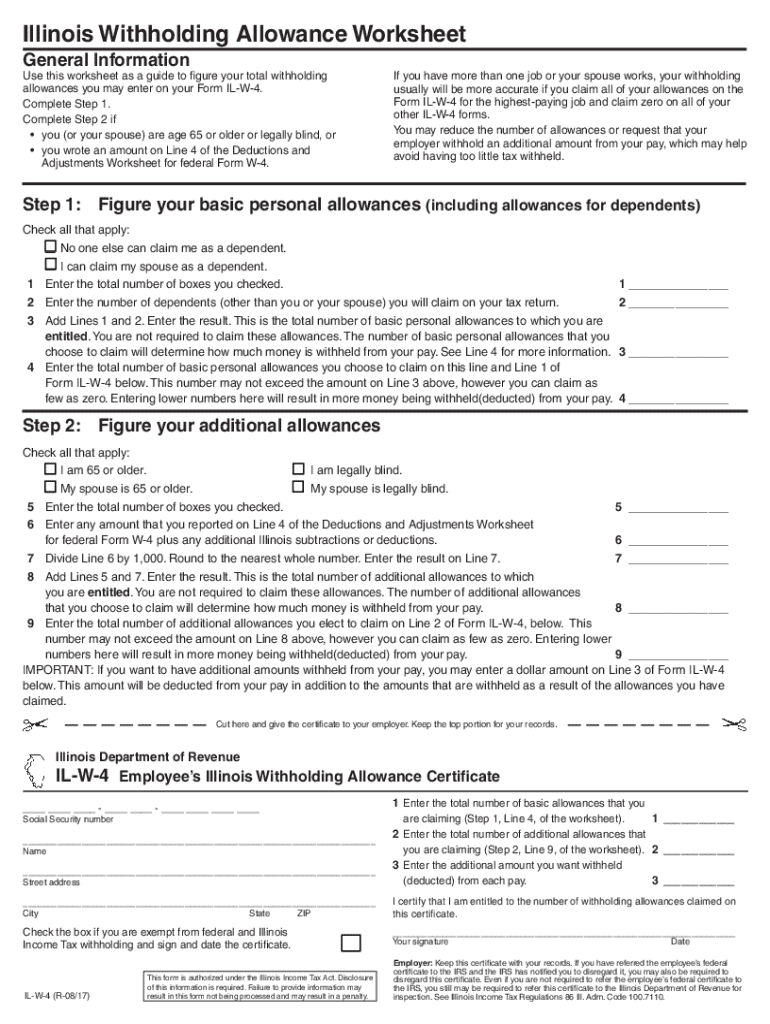

Illinois W4 Fill Out and Sign Printable PDF Template signNow

Follow the simple instructions below: Your withholding is subject to review by the irs. Working spouse or more than one job, figure. Web 47 votes how to fill out and sign 2017 form w 4 online? Get ready for this year's tax season quickly and safely with pdffiller!

Stop Celebrating Your Tax Refund Live Free MD

If you have a large amount of greater than $1,000,000. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation. Personal allowances worksheet (keep for your records.) enter “1” for yourself if no one else can claim you as a dependent a a c you are single and have only..

W4 (2017) Edit Forms Online PDFFormPro

States have a certain tax form like the federal form 1040 that is the first page of all state returns. Get ready for this year's tax season quickly and safely with pdffiller! Select the sign tool and create an electronic signature. Indicate the date to the template using the date tool. Personal allowances worksheet (keep for your records.) enter “1”.

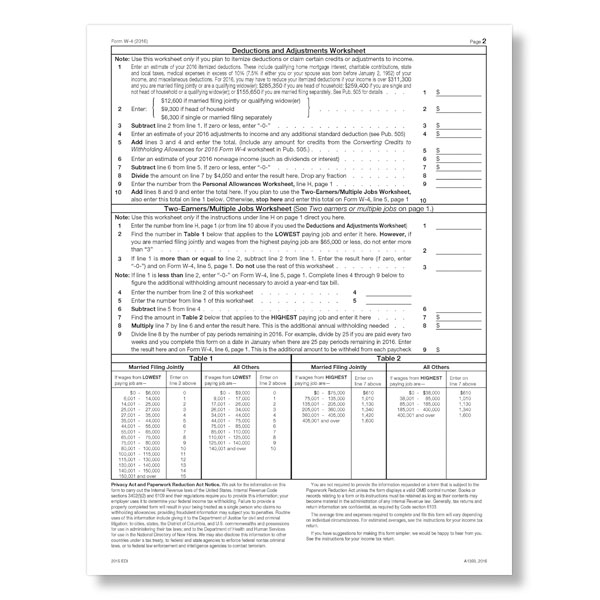

Nonwage income, such as interest or dividends, basic instructions. On average this form takes 10 minutes to complete. Working spouse or more than one job, figure. If you have a large amount of greater than $1,000,000. Select the sign tool and create an electronic signature. Get ready for this year's tax season quickly and safely with pdffiller! Download & print with other fillable us tax forms in pdf. Web to file 2017 state taxes, select your state (s), click on any of the state form links, then complete, sign the form online, and select one of the save options. Typing, drawing, or capturing one. Get your online template and fill it in using progressive features. If you are exempt, complete only lines 1, 2, 3, 4, and 7 and sign the form to validate it. Forms for california lutheran university browse california lutheran university forms fill has a huge library of thousands of forms all set up to be filled in easily and signed. Your withholding is subject to review by the irs. States have a certain tax form like the federal form 1040 that is the first page of all state returns. Follow the simple instructions below: Total number of allowances you are entitled. Print and mail these forms to your state, not the irs. Your withholding is subject to review by the irs. Once completed you can sign your fillable form or send for signing. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation.

Make An Additional Or Estimated Tax Payment To The Irs Before The End Of The Year.

Once completed you can sign your fillable form or send for signing. Web complete every fillable field. Personal allowances worksheet (keep for your records.) enter “1” for yourself if no one else can claim you as a dependent a a c you are single and have only. Your withholding is subject to review by the irs.

Type Or Print Your First Name And Middle Initial.

Employer can withhold the correct federal income. Web 47 votes how to fill out and sign 2017 form w 4 online? Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation. Forms for california lutheran university browse california lutheran university forms fill has a huge library of thousands of forms all set up to be filled in easily and signed.

Indicate The Date To The Template Using The Date Tool.

You will find 3 available options; Total number of allowances you are entitled. Typing, drawing, or capturing one. Enjoy smart fillable fields and interactivity.

Print And Mail These Forms To Your State, Not The Irs.

Get your online template and fill it in using progressive features. Web section 1, employee this part of the form must be completed no later than the time of hire, which is the actual beginning of employment. If you aren’t exempt, complete consider making estimated tax payments using form purpose. On average this form takes 10 minutes to complete.